When you pick up a prescription at the pharmacy, you might not think about why your insulin costs $15 one month and $120 the next. The reason isn’t your doctor’s choice or your pharmacy’s pricing-it’s your employer’s health plan and how it uses a formulary to decide what drugs you can get, and at what price. Most people don’t know this system exists until they’re hit with a surprise bill. But understanding how it works can save you hundreds-or even thousands-of dollars a year.

How Your Employer’s Drug Plan Works

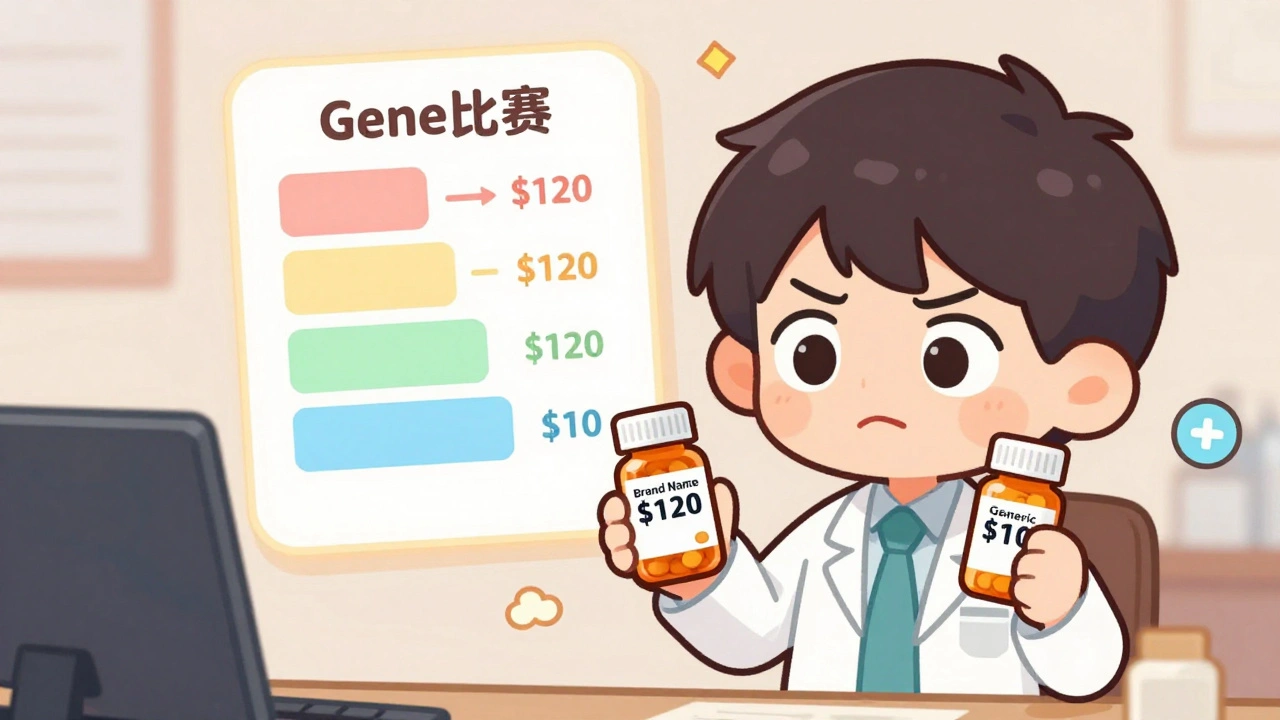

Nearly every large employer in the U.S. offers prescription drug coverage. According to Kaiser Family Foundation data, 99% of large group plans include it. But that doesn’t mean all plans are the same. What’s covered, and how much you pay, depends on a hidden rulebook called a formulary. This is a list of approved medications, organized into tiers. The lower the tier, the less you pay. Tier 1 is almost always for generic drugs. These are copies of brand-name medicines that have the same active ingredients, same effectiveness, and same safety profile-approved by the FDA. The only difference? They cost 80-85% less. That’s not marketing. That’s science. The FDA confirms generic drugs are just as safe and effective as their brand-name versions. Yet, many employees still avoid them, thinking they’re “weaker” or “lower quality.” They’re not. Tier 2 usually includes brand-name drugs that the plan prefers. These aren’t generics, but the insurer has negotiated a better price with the manufacturer. Tier 3 is for brand-name drugs that aren’t preferred-meaning you’ll pay more. Tier 4 is for specialty drugs: things like biologics for rheumatoid arthritis, cancer treatments, or rare disease therapies. These can cost hundreds or thousands per month. Here’s what typical copays look like, based on Ohio’s state employer plan data:- Tier 1 (generic): $10

- Tier 2 (preferred brand): $40

- Tier 3 (non-preferred brand): $75

- Tier 4 (specialty): 30-50% of the drug’s total cost

If your doctor prescribes a brand-name drug that’s in Tier 3, you’re paying more than seven times what you’d pay for the generic version. And if that brand drug gets replaced by a generic? The plan will automatically move the brand to Tier 4-and your out-of-pocket cost jumps overnight.

Why Generics Are the Smartest Choice

You’ve probably seen the ads: “$4 for a 30-day supply of metformin.” That’s not a sale. That’s the standard cost for a generic diabetes drug under most employer plans. The same medicine, sold under a brand name, can cost $300 or more. Why? Because the generic manufacturer didn’t spend $1 billion on clinical trials. They didn’t pay for TV ads. They just copied the formula after the patent expired. The savings are massive. According to Schauer Group, generic drugs save the U.S. healthcare system more than $150 billion every year. That’s $3 billion a week. And most of that money goes to employers and insurers-not directly to you. Here’s the catch: even though generics are cheaper, your plan doesn’t always pass the savings to you. Pharmacy Benefit Managers (PBMs)-companies like OptumRx, CVS Caremark, and Express Scripts-negotiate rebates with drugmakers. These rebates can be huge. KPMG found that, on average, the difference between a drug’s list price and what the PBM actually pays (called the gross-to-net spread) is 55%. That means if a drug lists for $100, the PBM might pay just $45 after rebates. But here’s the problem: you still pay your copay based on the original $100 list price. So even though the PBM got a 55% discount, you’re stuck paying as if the drug still costs full price. That’s why your out-of-pocket cost doesn’t drop even when the drug gets cheaper behind the scenes.

What Happens When Your Drug Gets Removed

In January 2024, each of the three largest PBMs removed more than 600 drugs from their formularies. That’s over 1,800 drugs gone in one month. These aren’t random cuts. They’re strategic. PBMs use exclusions as leverage to force drugmakers to offer bigger rebates. If a company won’t play ball, the drug gets dropped. If your medication is removed, you won’t get a warning. Your plan won’t call you. You’ll show up at the pharmacy, and they’ll say, “We don’t cover that anymore.” That’s when you’re forced to either:- Switch to a generic alternative (if one exists)

- Pay full price out of pocket

- Ask your doctor to file a medical exception request

Medical exceptions aren’t guaranteed. You’ll need documentation from your doctor proving the drug is medically necessary-often because generics caused side effects or didn’t work. The process can take weeks. During that time, you might go without your medication.

Some employers offer support programs. HealthOptions.org, for example, assigns care managers to help employees find affordable alternatives. These managers can help you apply for patient assistance programs, find coupons, or even negotiate with your PBM. But not every employer offers this. You have to ask.

How to Navigate Your Plan

You don’t have to guess what your plan covers. Here’s how to take control:- Go to your insurer’s website and look for the “Drug Formulary” or “Prescription Drug List.” It’s usually under “Benefits” or “Pharmacy.”

- Search for your medication by name. Note the tier and your copay.

- Check if a generic version is available. If it is, ask your doctor if you can switch.

- Read your Summary of Benefits and Coverage (SBC). It should explain tiers, prior authorization rules, and step therapy requirements.

- Call your insurer if anything’s unclear. Don’t assume you know what’s covered.

Also, check your plan’s formulary every few months. Changes happen without notice. A drug you’ve been taking for years could be moved to a higher tier-or removed entirely.

What Employers Are Doing About It

More employers are switching to Consumer Driven Health Plans (CDHPs), which pair high-deductible health plans with health savings accounts (HSAs). The goal? Make employees more cost-conscious. These plans often have stronger incentives for using generics: lower copays, higher HSA contributions, and sometimes even cash rewards for choosing generic drugs. Employers are also pushing education. Instead of just sending out benefits pamphlets, they’re using payroll stuffers, email campaigns, and even social media to explain why generics are safe and affordable. One company in Ohio saw a 40% increase in generic use after launching a simple “Generic Drugs: Same Medicine, Lower Price” campaign. But the real power still lies with PBMs. Employers don’t create the formularies-they buy them. The PBMs decide what’s on the list, what tier it’s in, and when it gets removed. Employers just sign the contract.What You Can Do Right Now

Don’t wait for your plan to change. Take action today:- If you’re on a brand-name drug, ask your pharmacist or doctor: “Is there a generic version?”

- If your drug was recently switched to a higher tier, ask why. Was a generic added? If so, switch.

- If your drug was removed from the formulary, don’t panic. Ask your doctor to file an exception. Meanwhile, check if your drug is available through a patient assistance program.

- Use in-network pharmacies. Some plans offer extra discounts only if you fill prescriptions at certain pharmacies.

- Ask your HR department if your employer offers a Price Assure Program or similar initiative that locks in low prices on generics.

Generic drugs aren’t a compromise. They’re the standard. The FDA doesn’t approve them as “cheaper alternatives.” They approve them as equal. The only difference is the price tag-and that’s something you can change.

Are generic drugs really as good as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict standards for quality, purity, and performance. The only differences are in inactive ingredients (like fillers or dyes) and packaging. Generics are not “weaker” or “lower quality.” They’re the same medicine, sold at a fraction of the cost.

Why does my copay go up even when the drug gets cheaper?

Because your copay is based on the drug’s list price, not what the pharmacy benefit manager (PBM) actually pays. PBMs negotiate big rebates from drugmakers-sometimes up to 55% off the list price. But you still pay your copay based on the original price. The savings go to the PBM and your employer, not necessarily to you. That’s why switching to a generic is the only reliable way to lower your out-of-pocket cost.

What if my medication is removed from the formulary?

First, don’t stop taking it. Contact your doctor immediately. They can file a medical exception request with your insurer, explaining why you need the drug. Meanwhile, ask if there’s a generic or alternative medication that would work. You can also check if the drugmaker offers a patient assistance program. Some companies give free or discounted drugs to people who can’t afford them.

Can I switch from a brand-name drug to a generic without my doctor’s approval?

In most cases, yes-if your plan allows automatic substitution. Pharmacists are often allowed to swap a brand-name drug for a generic unless your doctor writes “dispense as written” on the prescription. But for some medications, especially those with narrow therapeutic windows (like thyroid meds or seizure drugs), your doctor may prefer to monitor the switch. Always check with your pharmacist or doctor before making the change.

How often do formularies change?

All the time. New generics enter the market every month. PBMs update formularies quarterly-or even monthly-to reflect rebates, exclusions, and new drugs. A drug you’ve been taking for years could be moved to a higher tier or removed without notice. That’s why it’s important to check your plan’s formulary at least once every three months.

Ashley Elliott

December 4, 2025 AT 00:10Wow, I had no idea PBMs were keeping most of the savings...

I switched to generic metformin last year and saved $200/month. My doctor was skeptical at first, but I showed him the FDA data. Same pill, different price tag.

Now I check my formulary every quarter-seriously, it’s like a minefield. One month it’s covered, next month it’s gone. No warning.

HR sent out a pamphlet last year. Didn’t help. People still think generics are ‘cheap knockoffs.’ They’re not. They’re science.

My mom’s on a specialty drug. She had to file three exceptions before they approved it. Took six weeks. She went without. That’s not healthcare. That’s a game.

I wish employers would just pay for the actual cost, not the list price. Why am I paying $75 for a drug that costs $20 after rebates? That’s not fair.

And why do they remove drugs without telling us? I found out mine was dropped when the pharmacist handed me a receipt for $400. I cried in the parking lot.

But hey-at least I know now. I’m teaching my coworkers how to check their formularies. If we all do it, maybe they’ll stop treating us like idiots.

Generic drugs aren’t a compromise. They’re the default. The system is broken. But we can at least fight back with knowledge.

Also-yes, your thyroid med might need monitoring. But most people? Just switch. You’ll be fine.

Bill Wolfe

December 4, 2025 AT 01:12Let me just say this, with all the gravitas of a man who has read the full 800-page PBM contract appendix: the fact that you’re even *considering* generics as a viable option suggests a fundamental misunderstanding of pharmaceutical science and the integrity of clinical outcomes.

Generic manufacturers don’t replicate the *bioavailability curve* with the same precision as the original innovators-yes, the FDA says they’re ‘bioequivalent,’ but that’s a 90% confidence interval with a 20% margin of error. That’s not equivalence. That’s statistical gymnastics.

And don’t get me started on the excipients. The fillers, dyes, binders-they’re not inert. They’re *deliberately* chosen to be cheaper, and they alter absorption kinetics in ways that are rarely studied in post-market surveillance.

I’ve seen patients on generic levothyroxine develop subclinical hypothyroidism. Not because the active ingredient was wrong-but because the *delivery system* was compromised. And no, your pharmacist isn’t trained to recognize that.

It’s not about cost. It’s about *precision medicine*. If your life depends on a stable serum level, you don’t gamble on a $4 pill that’s been reformulated three times since 2022.

And yet, here we are. A nation of people who’d rather save $50 than risk their health on a pill that doesn’t come with a 10-year clinical trial and a celebrity endorsement.

It’s tragic. And it’s not just your plan. It’s the entire culture of commodification. 🤦♂️

Gillian Watson

December 5, 2025 AT 19:00John Filby

December 7, 2025 AT 19:00Man, I just found out my insulin was moved to Tier 4 last month. I didn’t know until I got the bill.

My pharmacist told me there’s a generic now-but it’s not approved for my type of diabetes. So I’m stuck paying $300 a month.

I called my HR rep. They said ‘check with your PBM.’ So I did. They didn’t answer my call. Left a voicemail. Still waiting.

I’ve been using this drug for 8 years. I didn’t even know they could drop it without telling me.

And the worst part? My employer’s website still lists it as ‘covered.’ So I thought I was fine.

Why do they make this so hard? We’re not doctors. We just want to live.

I’m going to ask for a meeting with my HR. I’m not the only one. I’ve talked to 3 coworkers who got hit the same way.

Maybe if we all speak up, they’ll stop treating us like numbers.

Also-thanks for this post. I didn’t know where to start. Now I do.

Emmanuel Peter

December 8, 2025 AT 00:26Let’s be real-this whole ‘generic is just as good’ thing is a scam pushed by PBMs to maximize profits.

You think they care about your health? No. They care about their 55% gross-to-net spread.

They remove drugs not because they’re unsafe-they remove them because the drugmaker won’t give them a bigger rebate.

And then they blame *you* for not switching.

My cousin was on a brand-name biologic for psoriasis. They dropped it. Switched her to a generic. She got a full-body rash. Took three months to get it back.

Now she’s on a different drug. Costs $12,000/month. Her insurance covers 70%. She pays $3,600.

Who won? The PBM. They got their rebate. You lost your health.

This isn’t healthcare. It’s corporate extortion.

And don’t even get me started on how they force step therapy-make you try five cheaper drugs before letting you take the one that works.

They’re not saving money. They’re just shifting the cost onto patients.

And now you’re telling people to ‘ask their doctor’ like that’s some magic solution.

Doctors are just as trapped as we are.

Chad Handy

December 8, 2025 AT 16:05I can’t believe people are still defending generics.

I had a heart attack last year. They put me on a generic blood thinner.

My INR levels went haywire. I ended up in the ER twice.

The doctor said, ‘It’s the same thing.’ But it wasn’t.

My body reacted differently. I had bruising everywhere. I couldn’t sleep.

They finally switched me back to the brand name. $400 a month. Worth every penny.

Now I tell everyone: if your life depends on it, don’t risk it.

Generic isn’t cheaper-it’s a gamble.

And the system knows it. That’s why they push it so hard.

They don’t care if you bleed out. They care about their quarterly earnings.

And now you’re telling people to ‘check their formulary’ like that’s some kind of empowerment.

It’s not empowerment. It’s survival mode.

I’m tired of being a pawn in this game.

Jenny Rogers

December 9, 2025 AT 18:48It is both morally and epistemologically indefensible to equate pharmacological equivalence with therapeutic equivalence, particularly in the context of a capitalist healthcare apparatus that incentivizes cost externalization at the expense of patient autonomy.

The FDA’s bioequivalence standards, while statistically robust, are predicated on population-level outcomes, not individual physiological variance-a critical oversight in the context of personalized medicine.

Furthermore, the opacity of PBM rebate structures constitutes a form of institutionalized fraud, wherein the consumer is systematically misinformed regarding the true cost of care, thereby violating the principle of informed consent.

That the average American citizen is expected to navigate this labyrinthine system without professional guidance is not merely negligent-it is a systemic violation of human dignity.

One cannot 'take control' of a system designed to disempower.

The solution is not individual vigilance, but structural reform: national formulary standardization, transparency mandates, and the abolition of PBM rebates as a conflict of interest.

Until then, we are all merely bargaining for scraps in a house built on exploitation.

And yet, you still believe a $10 copay is 'saving money'?

It is not saving. It is surrender.

Scott van Haastrecht

December 10, 2025 AT 07:58So let me get this straight-you’re telling people to just switch to generics because it’s cheaper?

That’s the advice? After all this? After seeing people lose their jobs because they couldn’t afford their meds?

And you think a 40% increase in generic use is a ‘win’?

It’s not a win. It’s a massacre.

My sister’s kid has epilepsy. They switched him to a generic seizure med. He had three grand mal seizures in two weeks.

They finally put him back on brand. Costs $8,000/month.

Insurance pays $5,000. We pay $3,000.

But hey-at least the PBM made their 55% rebate.

So congratulations, you win.

Meanwhile, kids are having seizures because someone decided ‘it’s the same drug.’

And you’re out here telling people to ‘ask their pharmacist’ like that’s a solution.

It’s not a solution. It’s a death sentence wrapped in a brochure.

Stop pretending this is about savings.

This is about profit.

And you’re helping them.

Chase Brittingham

December 10, 2025 AT 17:58Thank you for writing this. I’ve been too scared to speak up.

I’m on a generic for high blood pressure. Took me 6 months to find one that didn’t make me dizzy.

But once I did? I’ve been stable for two years. Saved $2,400.

My coworker just told me her insulin got pulled. She didn’t know until she got the bill. She’s crying at her desk.

I told her to go to HR and ask for a care manager. She didn’t even know that was a thing.

Maybe we need a Slack channel or something. Just a group where people can share what’s been pulled, what works, what doesn’t.

It shouldn’t be this hard to stay alive.

And yeah-generics aren’t perfect. But for most of us? They’re the only way.

We just need transparency. And support.

Not more blame.

Michael Feldstein

December 11, 2025 AT 16:12Hey-just wanted to say this post was super helpful.

I checked my formulary today and found out my generic lisinopril just got moved to Tier 2. My copay went from $5 to $15.

But then I saw there’s another generic-same thing, different manufacturer-still at $5.

I called my pharmacy. They said they can switch me. No doctor’s note needed.

So I did. Saved $10/month. That’s $120 a year.

Not life-changing, but it helps.

And I just sent my HR a quick email asking if they have a Price Assure program. They said yes-offered me a coupon for $3 off my next generic fill.

Small wins, right?

Thanks for the tips. I’m going to check my other meds next week.

And if anyone’s got a list of PBMs that are better than others? Hit me up.

We’re all in this together.