Prescription Coverage: What Your Insurance Really Pays For

When you pick up a prescription, you expect it to be covered—but too often, it isn’t. Prescription coverage, the portion of your drug costs that your insurance plan agrees to pay. Also known as drug benefits, it’s not a guarantee—it’s a puzzle with rules that change by plan, state, and even pharmacy. You might think if a doctor prescribes it, insurance has to pay. But that’s not how it works. Insurance companies use formularies, step therapy, and prior authorization to control costs, and those rules often block even basic meds.

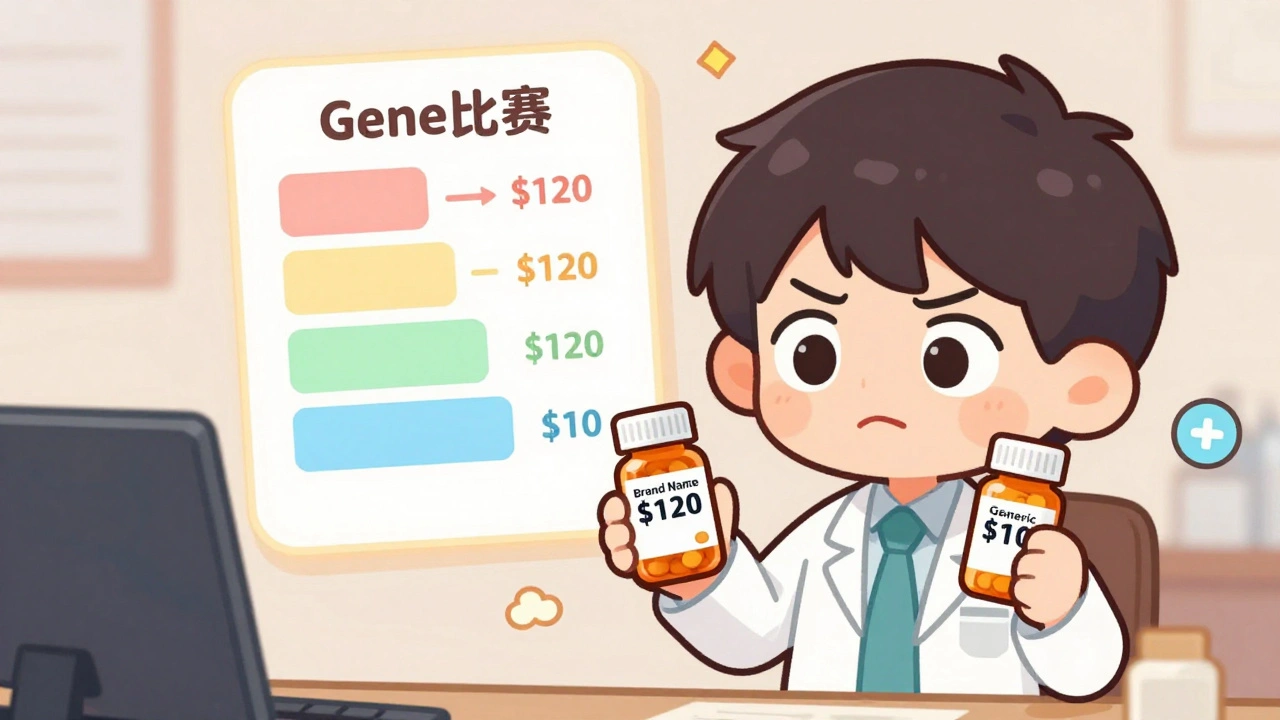

That’s why Medicaid prescription coverage, the government-funded drug program for low-income Americans. Also known as state drug plans, it varies wildly from one state to another. In some places, you can get your blood pressure med with a $1 copay. In others, you’re denied unless you try three cheaper drugs first. And when you’re denied a generic medication, a lower-cost version of a brand-name drug that’s chemically identical. Also known as generic drugs, it’s often the only affordable option for people on fixed incomes., you don’t just get a no—you get a mountain of paperwork. Many people give up. But you don’t have to. There are proven ways to appeal, and real people have won these fights by knowing exactly what to say and when to say it.

It’s not just about money. It’s about access. If your insulin, your heart med, or your antidepressant gets denied, it’s not a clerical error—it’s a system designed to push you toward cheaper options, even if those options aren’t right for you. That’s why prior authorization, the process where insurers demand proof before approving a drug. Also known as pre-approval, it’s a gatekeeping tool that can delay treatment for weeks. And why insurance appeal, the formal process to challenge a denied claim. Also known as drug coverage appeal, it’s your legal right—but only if you know how to use it. You’re not asking for a favor. You’re enforcing a contract. The posts below show you exactly how to do it: how to beat a denial, how to get your doctor to fight with you, how to find out what your plan really covers, and how to avoid the traps that make people skip doses or go without meds entirely.

What you’ll find here isn’t theory. It’s what people actually did when their insurance said no. From Medicaid patients in Texas to seniors in Ohio fighting step therapy, these are real stories with real solutions. No fluff. No jargon. Just the steps that work.

Employer Health Plans and Generic Drugs: How Formularies Control Your Prescription Costs

Learn how employer health plans use formularies to control prescription costs, why generics are your best bet, and what to do when your drug gets removed from coverage.

read more