Pharmacy Benefits: How Insurance, Generics, and Cost-Saving Rules Affect Your Prescriptions

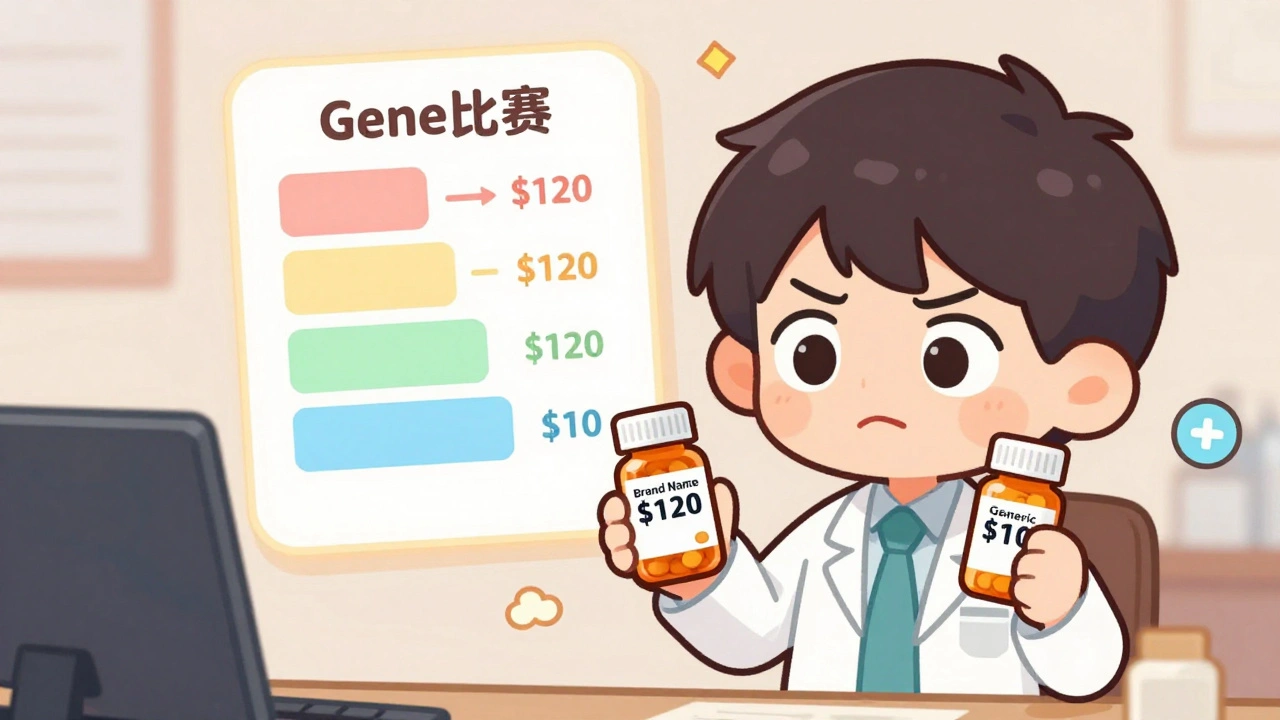

When you hear pharmacy benefits, the rules your health plan uses to decide which drugs are covered, how much you pay, and when you need approval. Also known as prescription drug coverage, it’s not just about having insurance—it’s about understanding the fine print that decides if your medicine is in or out. Most people assume if a drug is FDA-approved, it’s automatically covered. But that’s not true. Pharmacy benefits are controlled by formularies, tier systems, step therapy, and prior authorization rules that vary by plan, state, and even employer. What’s covered under Medicaid in one state might be denied under a private plan in another. And if your doctor prescribes a brand-name drug, your insurer might force you to try a cheaper generic drug, a chemically identical version of a brand-name medication that costs far less. Also known as generic medication, it’s often the first line of defense in controlling costs.

That’s why so many people end up fighting insurance coverage, the process of getting a drug approved by your plan after it’s been denied or restricted. Also known as prior authorization appeal, it’s not just bureaucracy—it’s a system designed to slow down expensive prescriptions, even when they’re medically needed. You might be prescribed a drug that works, but your plan says you have to try three cheaper ones first. That’s step therapy. Or your generic gets flagged because the batch you got had a manufacturing flaw—something that’s more common than you think. Pharmacy benefits don’t just care about cost; they care about risk, too. That’s why some prescriptions require a doctor’s note, a lab result, or even proof you’ve tried lifestyle changes first. And if you’re on Medicaid or a Medicare Part D plan, the rules get even more complex—copays change, formularies shift yearly, and Extra Help programs can make a huge difference if you qualify.

Underneath all this is a simple truth: pharmacy benefits are meant to save money, but they often cost patients time, stress, and sometimes health. The posts below show you exactly how these systems work—and how to beat them. You’ll find real guides on appealing denied generics, understanding why your insurer won’t cover a drug, spotting dangerous interactions caused by cost-cutting, and knowing when brand drugs are truly necessary. You’ll see how Australia’s PBS keeps drugs affordable, how Medicaid formularies change in 2025, and why some people are stuck paying hundreds extra just because their plan doesn’t list their medicine. These aren’t theory pieces—they’re field manuals for navigating the real world of pharmacy benefits. Whether you’re paying out of pocket, fighting a denial, or just trying to stretch your budget, the answers are here.

Employer Health Plans and Generic Drugs: How Formularies Control Your Prescription Costs

Learn how employer health plans use formularies to control prescription costs, why generics are your best bet, and what to do when your drug gets removed from coverage.

read more