Employer Health Plans: What They Cover and How to Get the Most Out of Them

When your employer offers health coverage, it’s not just a benefit—it’s your main gateway to affordable medications. Employer health plans, insurance programs provided by companies to employees, often include prescription drug coverage, preventive care, and specialist visits. Also known as group health insurance, these plans vary wildly in what they pay for, how much you pay out of pocket, and how much control you have over your choices. Many people assume their plan covers everything, but that’s rarely true. Formularies, step therapy rules, and prior authorization requirements can block access to the exact drug your doctor recommends—even if it’s the safest or most effective option.

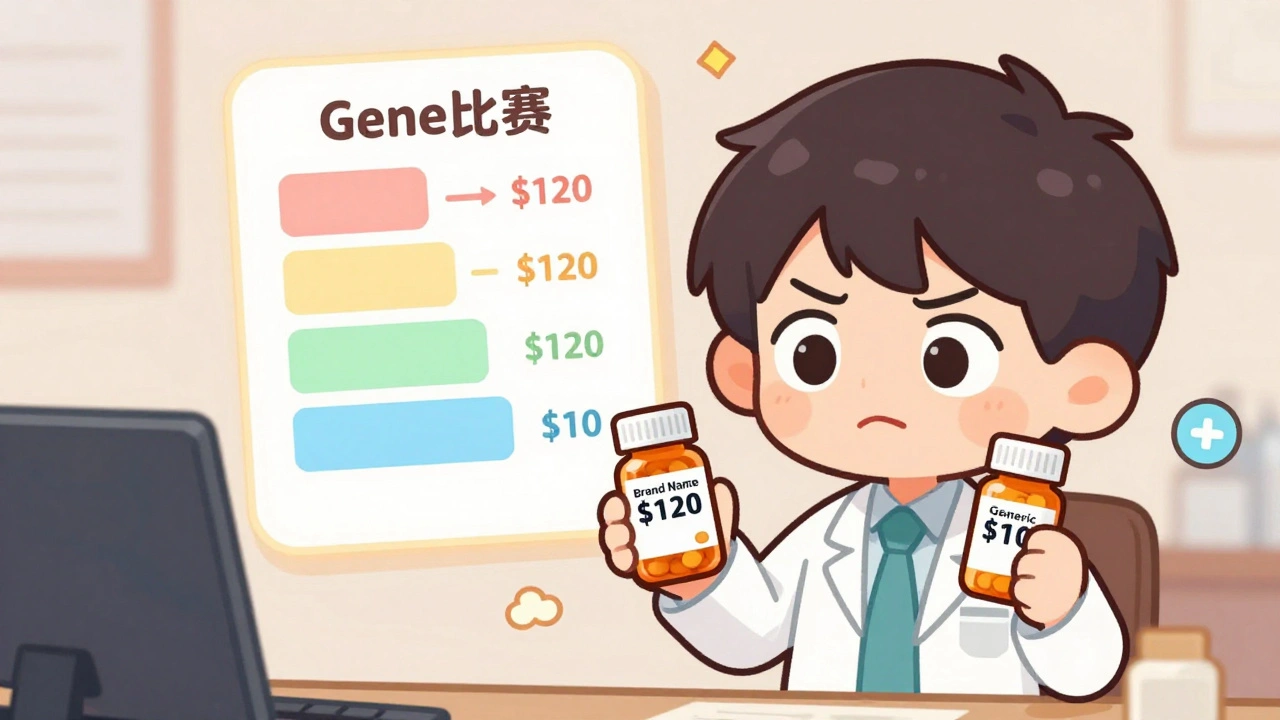

One of the biggest pain points? Getting your generic medications approved. Even though generics are chemically identical to brand-name drugs and cost up to 80% less, insurers often make you jump through hoops. You might be forced to try cheaper alternatives first (step therapy), or your plan might deny coverage outright unless your doctor files a prior authorization. That’s where knowing how to appeal insurance denials, a formal process to challenge a coverage refusal becomes critical. Real people have won appeals by submitting doctor letters, citing clinical guidelines, and using the right forms—sometimes even getting their medication covered retroactively.

And it’s not just about generics. Your plan’s rules affect everything: from whether you can refill a prescription early after hospital discharge, to whether you’re allowed to use a pill organizer safely without triggering billing errors. Medicaid prescription coverage, a government program for low-income individuals that also overlaps with employer plans in some cases has its own formularies and copay rules, but even people with private insurance face similar barriers. If you’re on long-term steroids, blood thinners, or acid-reducing meds, your employer plan might not warn you about dangerous interactions—so you have to ask. Temperature control for storage? Lot number recalls? These aren’t just pharmacy details—they’re safety issues your plan might ignore unless you push for them.

Employer health plans don’t come with instruction manuals. You’re expected to know how to navigate prior authorizations, understand copay tiers, and recognize when a drug is being denied for cost—not clinical reasons. The good news? You’re not alone. Thousands of people have fought denials, switched to generics safely, and learned how to use their benefits without getting burned. Below, you’ll find real guides on how to appeal a denied prescription, how to check if your generic drug has manufacturing defects, how to reconcile meds after leaving the hospital, and how to save money without risking your health. These aren’t theoretical tips—they’re steps real patients have taken to take back control of their care.

Employer Health Plans and Generic Drugs: How Formularies Control Your Prescription Costs

Learn how employer health plans use formularies to control prescription costs, why generics are your best bet, and what to do when your drug gets removed from coverage.

read more